EUR/JPY Fails to Retest 15-Year Peak

EUR/JPY

EUR/JPY

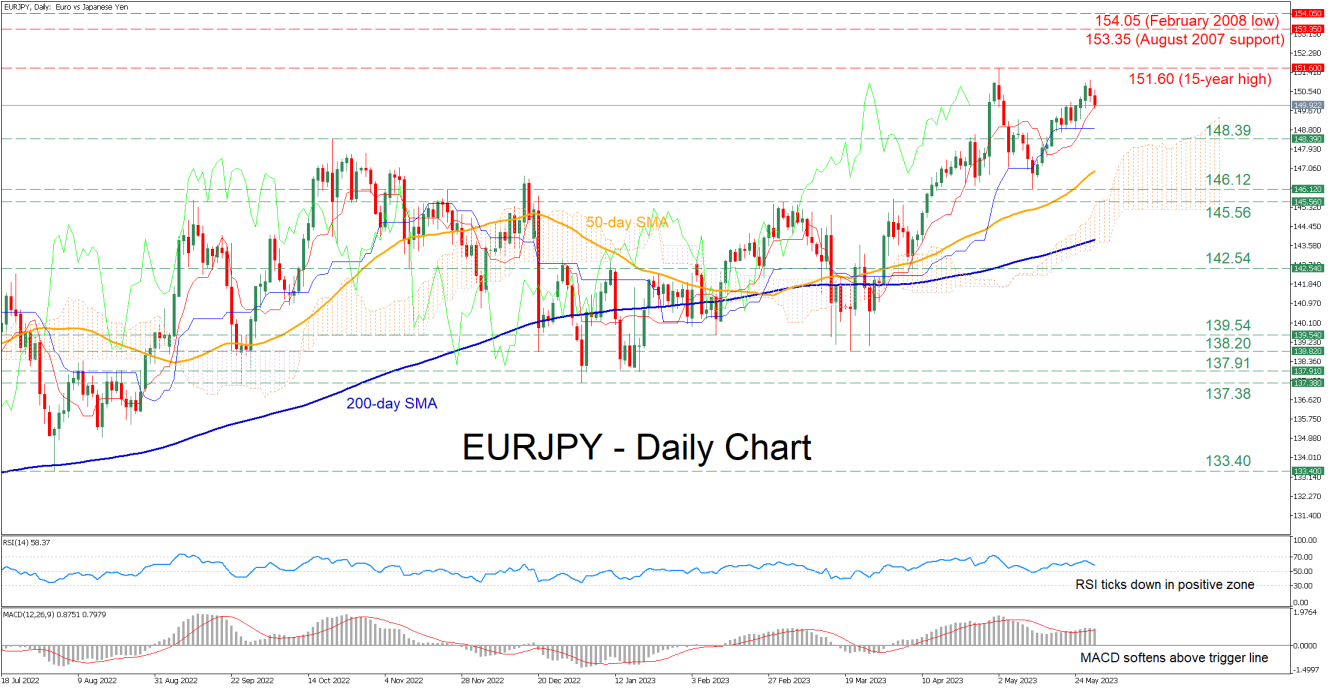

EURJPY had been in a strong uptrend, which ceased at a fresh 15-year high of 151.60 in early May and the pair corrected to the downside. Even though it quickly found its feet and stormed back higher, the latest rebound seems to have faltered just shy of the recent high, potentially forming a double-top pattern.

The short-term oscillators currently reflect a loss of positive momentum. Specifically, the RSI lost some ground but still holds above its 50-neutral mark, while the MACD softened above both zero and its red signal line.

If the recent weakness persists, the October 2022 high of 148.39 could serve as initial support. Retreating lower, the pair could challenge the May low of 146.12 before the 145.56 hurdle appears on the radar. Should that barricade fail, the April bottom of 142.52 could prove to be a tough one for the bears to overcome.

On the flipside, bullish actions could trigger an advance towards the 15-year peak of 151.60. Jumping above that zone, the pair might ascend to form fresh multi-year highs, where the August 2007 support of 153.35 may cap the upside. A violation of that region could set the stage for the February 2008 low of 154.05.

Overall, EURJPY’s latest rebound seems to be running out of steam, with a potential extension of the recent pullback hinting towards the formation of a double-top pattern. Nevertheless, a fresh higher high could open the door for the resumption of the medium-term uptrend.