Bitcoin, Ethereum Could Be Setting Up for Breakouts This Week

BTC/USD

+0.90%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

ETH/USD

+0.71%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

- Both Bitcoin and Ethereum tested their resistances last week

- However, bulls failed to gather necessary momentum for a breakout

- Both cryptos should look for a new test of the resistances this week

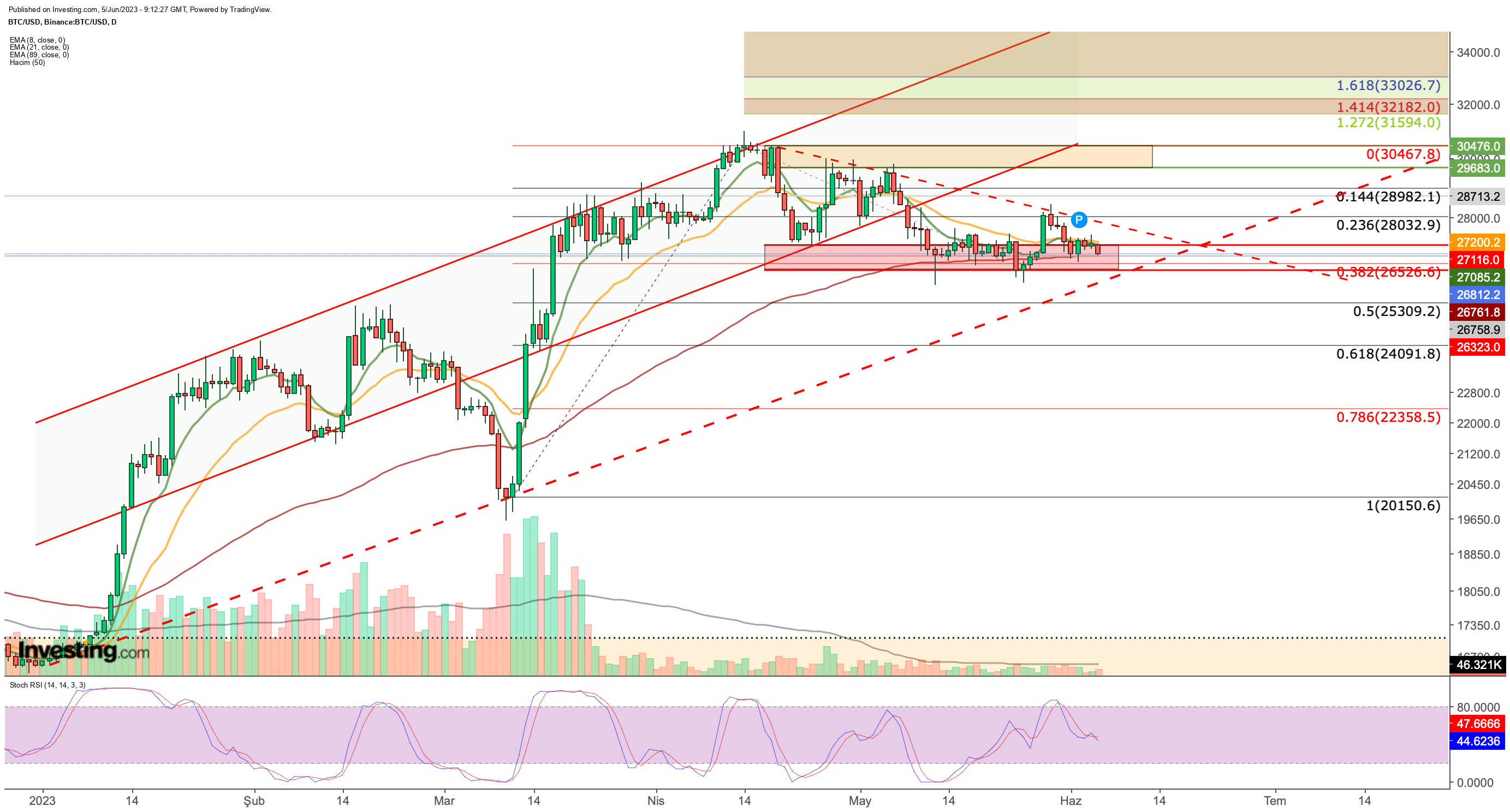

Bitcoin has maintained a narrow trading range between $26,300 and $27,300 for about a month. The declining trading volume suggests a consolidation phase for the cryptocurrency.

However, price movements breaching the range have lacked the necessary momentum to spark a significant trend reversal.

BTC/USD Price Chart

BTC/USD Price Chart

BTC recently encountered resistance at the $28,000 level. Currently, the $26,500 level has acted as a reliable support. Additionally, the $26,300 level, which has been tested twice within the past month, is a crucial support level.

A close below $26,500 this week could result in the cryptocurrency breaking its 2023 uptrend. This breach could be a trend reversal for BTC, and a new downtrend targeting support levels at $25,300, $24,100, and $22,350, could ensue.

The cryptocurrency has to stay above $27,100 to avoid downside risks. Such a breakthrough would indicate an increase in buyer volume, providing BTC with the strength to surpass the $28,000 resistance level.

In the event of a potential recovery, BTC may encounter intermediate resistance around $29,000, following the $28,000 mark. Subsequently, close attention will be paid to the main resistance zone ranging from $29,600 to $30,500.

This zone aligns with the midline of the ascending channel movement observed in 2023 and will be a critical price range to monitor for the continuation of the uptrend.

On the daily chart, moving averages support the $26,500 — $27,100 band as an important support zone. BTC price is currently between the short-term EMA values.

In this case, the EMA value positioned at $26,500 confirms that this level is a critical support point. At the same time, the coincidence of the 89 EMA with the bottom line of the ascending channel increases the probability of a breakout.

To summarize, Bitcoin’s net close of the day below $26,500 or a drop in volume technically indicates that the price could trigger a rapid decline.

Ethereum

Ethereum enters the week following the ascending trend line. However, it faces challenges in breaking the short-term downtrend line that started in mid-April.

ETH/USD Günlük Grafik

ETH/USD Günlük Grafik

The ETH daily chart currently shows a triangle formation, suggesting that the price may soon experience increased volatility. If ETH closes below $1,850, it could indicate a downward breakout from the triangle, leading to a potential decline toward $1,660.

On the other hand, if ETH opens and closes above $1,950, it would confirm an upside breakout and may set a target of $2,100, which is a key level.

Find All the Info you Need on InvestingPro!

Find All the Info you Need on InvestingPro!