Pandora Stock Completes Elliott Wave Correction

PANDY

+0.40%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

The share price of Danish jewelry maker Pandora (OTC:PANDY) is down 19% over the past three months. However, it is still up 10% since we turned bullish a year ago, in June, 2022. The question is, should we sell while still at a small profit or wait and hope for a bigger one?

Fundamentally speaking, there are two conflicting sides to this story. On one hand, Pandora is a financially sound, growing, and profitable business with a strong brand and competent people at the helm. On the other hand, a US recession seems to be fast approaching. In that case, investing in a jewelry company whose biggest market is the US is like picking up pennies in front of a train.

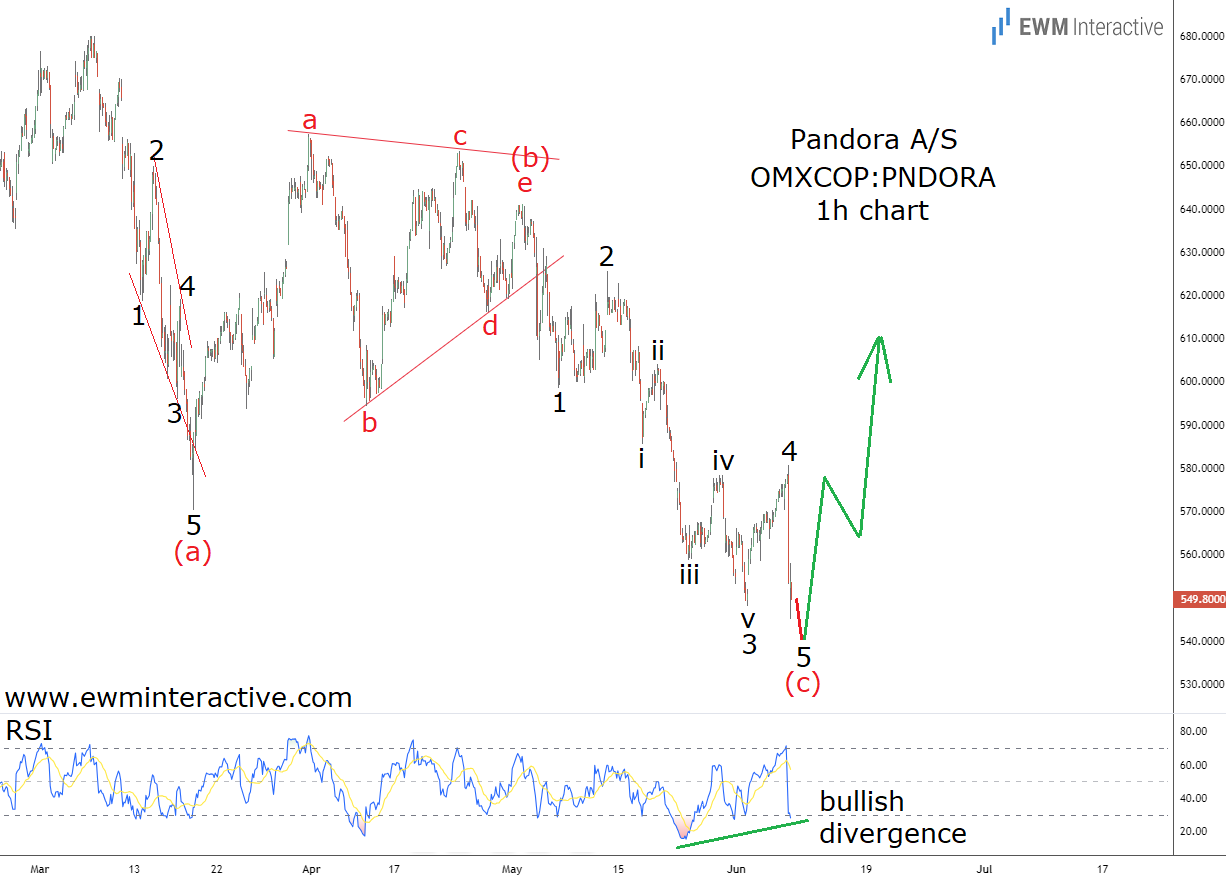

Obviously, focusing on the business and the macro situation won’t give us a clear answer. What tilts the odds in favor of the bulls for us is the Elliott Wave analysis. Applied to the hourly chart of Pandora stock, it suggests that the uptrend can be expected to resume very soon.

Pandora Stock 1-Hr Chart

Pandora Stock 1-Hr Chart

Pandora‘s 1h chart reveals the stock’s slide from DKK 680 to DKK 545 so far. It can easily be seen as a simple (a)-(b)-(c) zigzag correction. Wave (a) is a leading diagonal, followed by an a-b-c-d-e triangle in wave (b). Wave (c), the last one of the sequence, is a textbook five-wave impulse marked 1-2-3-4-5. The five sub-waves of wave 3 are also visible and labeled i-ii-iii-iv-v.

If this count is correct, we can expect Pandora to head north again as soon as wave 5 of (c) is over. In addition, the RSI indicator gives another reason for optimism by showing a clear bullish divergence between waves 3 and 5. Not to mention that the company is on track for DKK 60 in EPS this year. This means that the stock is currently trading at an undemanding P/E ratio of 9. We won’t be surprised if it doubles over the next year or so. That’s why Pandora, along with 17 others, is part of our stock portfolio.