S&P 500: Earnings Yield Supports Technically Overbought Market

US500

+0.69%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Technically the S&P 500 is now in the “extreme overbought” range per this weekend’s Bespoke chart.

S&P 500 50-Day MA Spread

S&P 500 50-Day MA Spread

S&P 500 Earnings Yield

It’s a metric that occasionally gets tossed around in the plethora of blogs and weekend reading, but the S&P 500 earnings yield (EY) is quickly dropping towards 5%, which is a level at which investors want to start paying attention.

The 5% level is usually the level that signals the S&P 500 needs a good flush, or correction, to reset the bar.

Here’s the trend in the S&P 500 earning yield in 2023:

- 5.25%

- 5.27%

- 5.34%

- 5.35%

- 5.45%

- 5.47%

- 5.42%

- 5.37%

- 5.58%

- 5.54%

- 5.81%

- 6.50%

- 6.42%

In late 2022, the EY hit 6.50% the week ended 10/14/22 and then again hit 6.42% the week of 6/17/22, both major lows for the S&P 500 last year.

In early Feb ’22, the EY traded between 4.50% and 5% thanks to the elevated S&P 500.

The EY is a broader market-timing measure. A drop in the EY below 5% will definitely get attention, but a good flush often fixes it and doesn’t necessarily indicate a prolonged bear market.

Fundamentals and technicals are aligning to tell investors the S&P 500 is getting extended.

Fed Funds Range

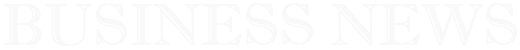

CME Fed Watch Tool

CME Fed Watch Tool

With the FOMC meeting Wednesday, June 14th, all eyes are on the 70% chance of no hike in fed funds this week. Note how the probability of a 25 bp hike for July ’23 continues to edge higher.

The reason for the FOMC pause could be the T-bill issuance around the Treasury’s refilling of the TGA (Treasury general account). Mike Zaccardi, a frequent publisher of his work on Twitter (@MikeZaccardi) and whose work is first rate (in my opinion) posted a note from Bank of America (NYSE:BAC) this week, noting that the TGA replenishment by the Treasury is the equivalent of a 25 basis point hike anyway.

Watch the July ’23 fed funds range probability. That’s the key.

May CPI and PPI This Week

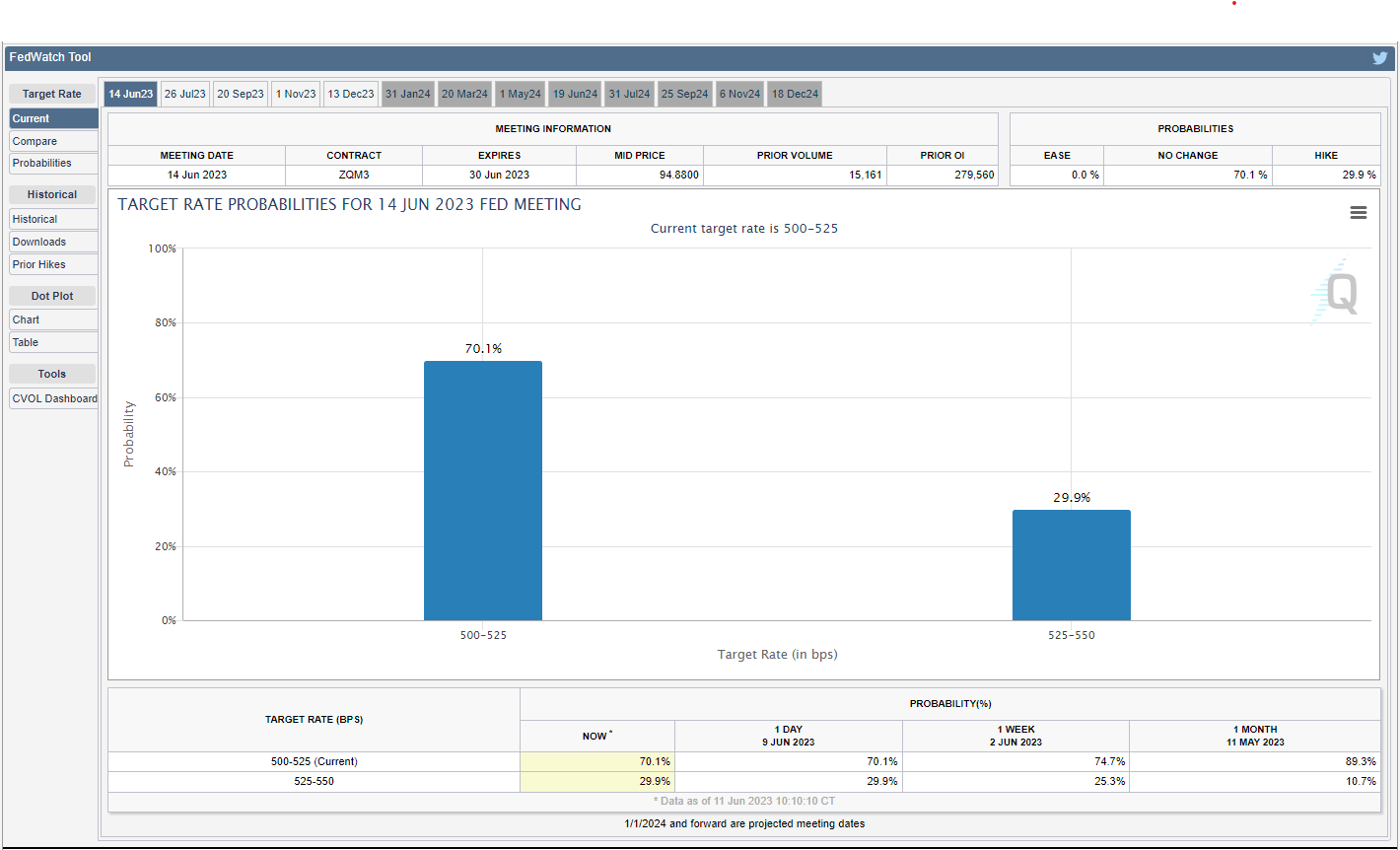

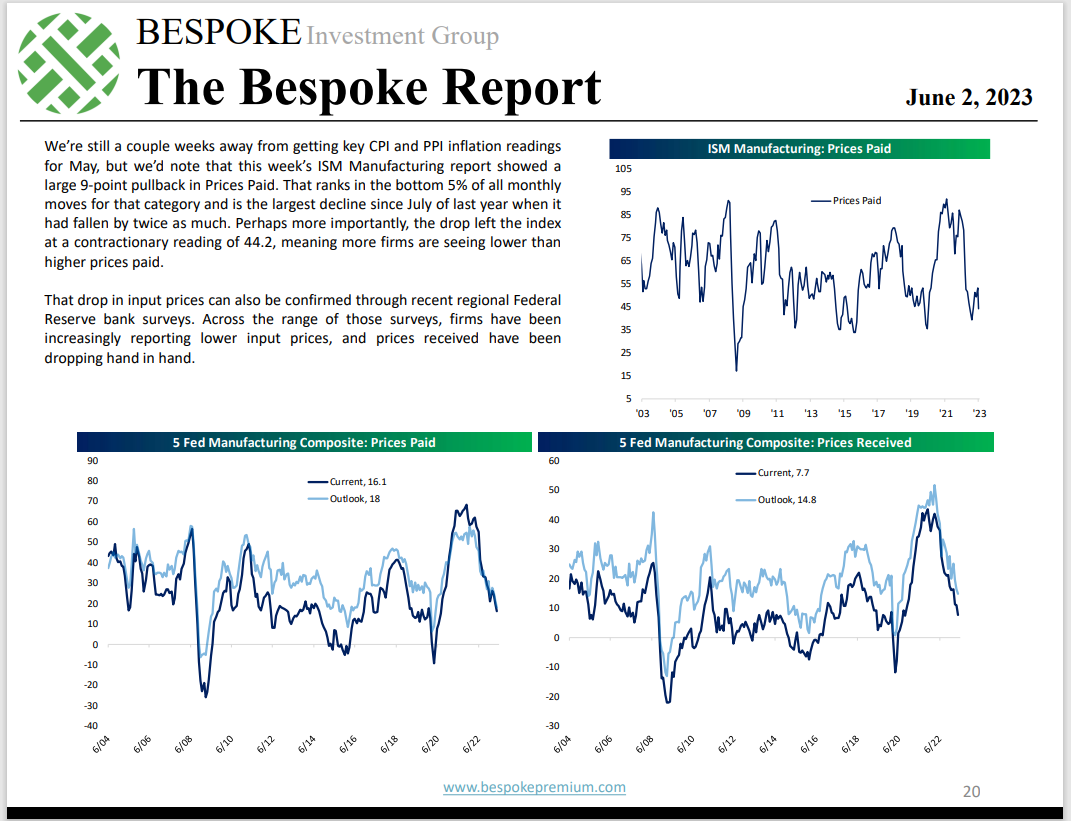

Bespoke Report

Bespoke Report

May CPI-PPI

May CPI-PPI

These two pages from the Bespoke Report of last week, June 2nd, perfectly explain the math around the CPI and PPI data this week. Even slightly higher-than-expected prints this week on Tuesday (May CPI) and Wednesday (May PPI) would not derail the downward pressure on the fixed-weight indices.

The way I read the bottom of p.21 is that even if CPI is +0.4% this week, the CPI still comes in at 73 basis points better (y.y) at 4.20% than April’s 4.93% rate. (These tables from Bespoke are greatly appreciated, but I wish Paul Hickey and the crew would do something similar with the PCE deflator’s “services” measure.)

While fixed-weight inflation measures are helpful, it’s the deflator – and in this case, the PCE deflator – that has the Fed / FOMC’s attention.

S&P 500 Data

- The forward 4-quarter estimate (FFQE) declined one thin penny this week ot $224.49 from last week’s $224.50;

- The PE estimate on the forward estimate is now 19x

- The S&P 500 earnings yield dropped this week to 5.25%, all of which was covered above;

SP500 Earnings Rate Of Change

SP500 Earnings Rate Of Change

Readers need to look at this data as much as I do, but the lesson in today’s table is that downward pressure on the forward estimates along the “S&P 500 earnings curve” has all but stopped.

That’s unusual at this time during the quarter. Analysts are still usually looking for reasons to trim numbers ahead of Q2 ’23 earnings.

Those first rows of numbers are the bottom-up, quarterly EPS numbers summed for each quarterly bucket going out through 2024. Rather than just annual S&P 500 EPS estimates – which can suffice for valuation purposes – the earnings curve gives readers more precise insight into actual earnings estimates.

Conclusion

Over the next few weeks, investors get insight into a broad swath of the S&P 500 and the economy with earnings releases from Oracle (NYSE:ORCL), and then in the next two weeks, FedEX (FDX), KB Home (NYSE:KBH), Nike (NYSE:NKE), Accenture (NYSE:ACN) and then Micron (NASDAQ:MU) (MU Technology, the last week of the quarter. While Micron isn’t Nvidia (NASDAQ:NVDA), it’s a good look at the DRAM and NAND markets both from a supply and demand perspective, and the semiconductor sector has been leading since last October ’22’s low.

The smoke signals are lining up to indicate the S&P 500 is getting pretty overbought, but worries over a large pullback seem exaggerated. It’s fascinating to read all the recession prognostications for well over 18 months now, and yet pressure remains on higher Treasury yields. The labor market seems like it could be the last shoe to fall, so don’t forget jobless claims coming out Thursday morning, June 15th.

If the CPI and PPI data come in better-than-expected, it will continue to give the FOMC inflation hawks more reason to constrain their hawkish monetary policy instincts.

Take all this with a grain of salt. None of what’s written on this blog is to be construed as investment advice, and past performance is no indicator or predictor of future results. Capital markets change quickly for both the good and the bad. Be sure and gauge your own personal appetite for market volatility.